The Whole is greater than the sum of its parts – Aristotle.

Over the decades of my career, there are 2 business leaders I have really admired and followed their industry quite passionately. One of them is Sir Martin Sorrell and the other one-I-will-blog-about-later 😉 These two are my professional inspirations. Hint – these two do the same thing, but in different industries. One in Marketing & Advertising world and the other in Software/Tech world. Both scale their holdings on acquisition of BRANDS.

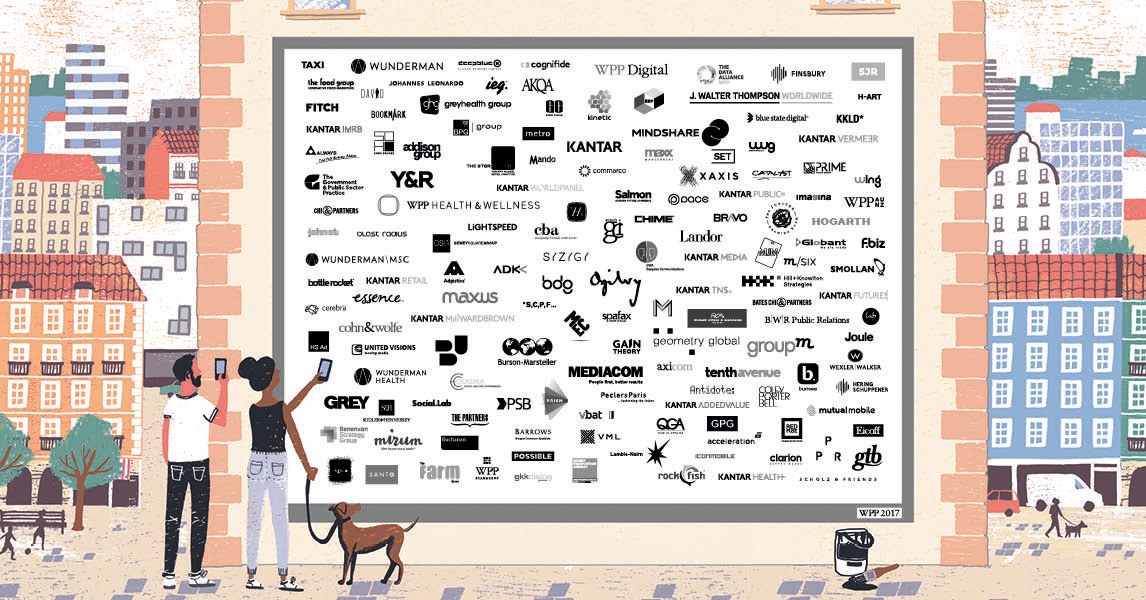

Martin’s chutzpah in acquiring ‘Wire and Plastic Products plc (WPP)’ and creating the world’s largest ‘Agency’ network redefined what a marketing agency industry should look like. Over decades, WPP went on an acquisition spree to tuck in bands like JWT, Ogilvy&Mather(loved the takeover here), AKQA, Essence, Mindshare, Wavemaker among many others. This created a ‘Full Service’ agency network.

The ‘Network’ offers advertising, marketing, data & operations, design, PR & Comms , and now increasingly Digital & Technology services to enterprises across the globe. Whether it is designing a logo OR a PR strategy OR a marketing campaign OR market analysis OR a TV advertisement OR sales catalog pictures OR programmatic advertising on Google or Facebook, the ‘Agency Network’ has services on offer for the CMO (Chief Marketing Officer) or the CDO (Chief Design Officer) or CDO(Chief Digital Officer). It’s not only about B2C marketing but B2B as well – helping sales organizations do prospecting or Account Based Marketing is a differentiated offering of these networks.

But what really intrigued me was how WPP and its acquisitions operated – as INDEPENDENT brands. WPP operated as a holding company and post acquisition the agencies operated independently as a part of ‘The Agency Network’. Each had their own specialisation and often competed with each other for the CMO/Market Department’s budget and services. This is counter intuitive to how I have seen acquisitons happen. Nip-and-Tuck.

I learnt along the way the genius in doing a ‘network’ of agencies allows each independent company to retain not only their brand but specialisation as well. Customers were comfortable with a particular agency brand’s style of functioning and the specialisation brought in focus and the most important ingredient – innovation and creativity. With changing times, these ‘networks’ continue to acquire new digital companies to ensure they keep up with the demand of a new age CMO/CDO. Don’t be surprised to hear them having ‘Salesforce’, ‘Adobe’, ‘Shopify’, ‘Hadoop’ and other technology service companies in their network now. As things become more digital, these ‘networks’ need to offer more tech services to their customers. The AdTech, MarTech and SalesTech stack is disrupting the market and keeping these agencies on their toes.

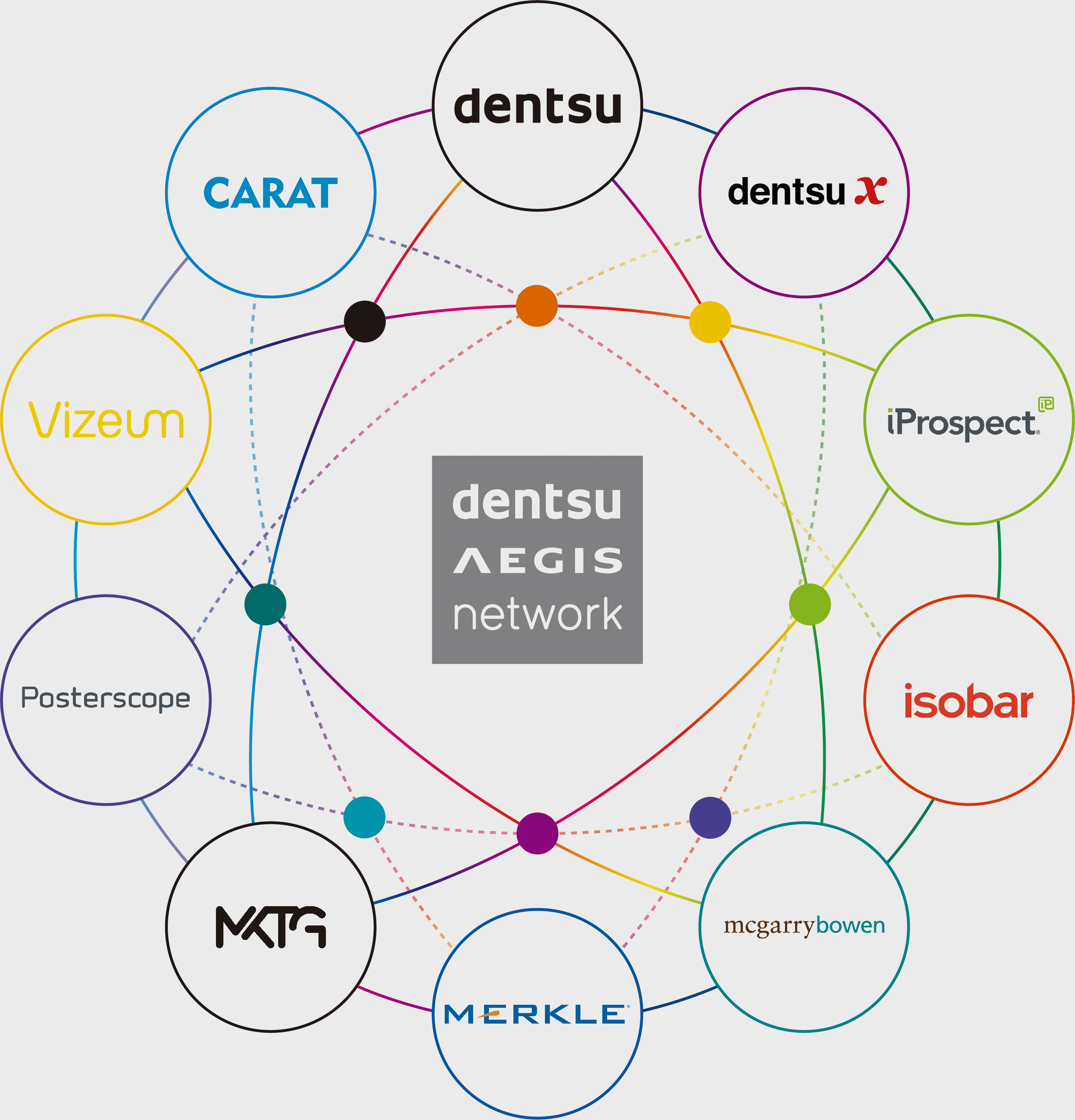

WPP is not unique. There is Publicis, Dentsu Aegis Network(DAN), Omnicom and many more. In fact, post his ouster Martin created a WPP-compete company called S4 Capital (now Media.Monks) that is built on the same strategy – though with a stronger focus on digital & technology led CMO services.

I treasure my stint at Adobe where I got to manage these network partnership that gave me unique insights into their operations, dynamics, struggles and strategy. My meeting with the WPP CEO, Mark Read helped me understand how a large agency network is working to align its strategy and portfolio (as well future acquisitions) around Communications, Experience, Commerce & Technology. Discussions with DAN leadership helped understand the double-down bets on digital. Many of my friends have sold their companies into these networks and I find a privileged position sometimes discussing and advising on strategy – getting a ring side view thereby.

In my view, what these ‘Networks’ have as advantages and disadvantages

+ve: Allows the independent brand/company to pursue its own innovation and growth strategy

+ve: Some of these independent companies have created a phenomenal brand presence that attracts customers (think O&M !) as long term relationships.

+ve: There are collaboration possibilities with one brand bringing in another to help the customer. This allows business to remain within the ‘Network’

-ve: I’ve seen competing agencies undercutting each other in a customer bid (I’m sure it does not fare well for the holding company)

-ve: As with any other large organization, sometimes aligning these different network companies towards a shared vision and purpose is not always a cakewalk

This successful ‘agency network’ strategy does beg the question – can it be extended to other industries, especially pure-tech ? No matter what industry you operate in, Strategy 101 dictates you either move up or down the stack to make your offering complete.

NTT has done this of late (over the last 7 years) , acquiring different brands across the globe. Some it has let run as an independent brand and some under the NTT brand itself.

I can not tell a lie, I toyed with creating a network that can tuck together different tech service company brands targeting the CIO, CTO and CDO. A sugar daddy had lined up a SPAC model to fund it but I ended up doing another startup in its place.

But I do think there is an opportunity to apply this agency model for a “Services Network” and who knows, maybe even a “SaaS Network” to bring in economies of scale for GTM and coverage of a “Fully Serviced” customer model of the future. With SaaS become increasingly fragmented and focused by vertical/need – shouldn’t there be a holding company offering all SaaS tools for a CMO or a CHRO or a CPO ? This is not only about a holding company probably. Maybe for a SaaS provider, moving up and down the stack might warrant acquisitions of its own to move horizontally in their offering.

What do you think ? Isn’t TATA Trust similar to a network ? Aren’t global FAANGs creating their own network of brand holdings ?

Side note, checkout ‘Authentic Brands Group’ , an awesome idea of amalgamating brands and monetizing them.

Appendix :

WPP Network

Publicis Network

Detnsu Aegis Network

Leave a comment